after tax income calculator iowa

After gross income less standard deduction or itemized deduction that is taxable income subject to Federal income tax. You must calculate interest on the 500 and add it to the 550.

How Much Should I Set Aside For Taxes 1099

Simply enter your annual or monthly income into the tax calculator above to find out how US taxes affect your income.

. After a few seconds you will be provided with a full breakdown of the. Iowa collects a state income tax at a maximum marginal tax rate of spread across tax brackets. This results in roughly 35339 of your.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Ad Find Recommended Iowa Tax Accountants Fast Free on Bark. Iowa Paycheck Calculator - SmartAsset.

Your total unpaid tax and penalty is now 550. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Your average tax rate is 222 and your marginal tax rate is 361.

In the US the concept of personal income or salary usually references the before-tax amount called. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Federal Income Tax Rate.

If you filed your return on time but did not pay at least 90 of the correct tax due. 328 rows After determining their Iowa state tax liability many Iowa taxpayers. Get Your Max Refund Today.

Enter your info to see your take. Iowa does not have any local. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

SmartAssets Iowa paycheck calculator shows your hourly and salary income after federal state and local taxes. Calculate your Iowa net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Iowa paycheck. Get Your Max Refund Today.

Based on your projected tax withholding for the year we can also estimate. This Iowa bonus tax calculator uses supplemental tax rates to calculate withholding on special wage payments such as bonuses. Free Online Paycheck Calculator Calculate Take Home Pay 2022.

If you make 140000 in Iowa what will your salary after tax be. Ad Calculate your federal income tax bill in a few steps. Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This.

For instance an increase of. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period. Fields notated with are required.

Iowa tax law stipulates that your Federal taxes may be deducted from your gross income for purposes of computing the State income tax. So S - F Adjusted Taxable income for Iowa. Youll then get a breakdown of your total tax liability and take-home.

Enter your filing status income deductions and credits and we will estimate your total taxes. The rate ranges from 033 on the low end to 853 on the high end. Our income tax and paycheck calculator can help you understand your take home pay.

100s of Top Rated Local Professionals Waiting to Help You Today. Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. The Iowa bonus tax percent calculator will tell you what your.

A simplified Tax Calculator for HOH Single and Married filing Jointly or Separate. The Federal income brackets from 10 to. See what credits and deductions apply to you.

Unlike the Federal Income Tax Iowas state income tax does not provide couples. This marginal tax rate means that your immediate additional income will be taxed at this rate. Related Income Tax Calculator Budget Calculator.

If you would like to update your Iowa withholding. Iowa charges a progressive income tax broken down into nine tax brackets. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income.

Ad Enter your tax information. Filing 12000000 of earnings will result in 635049 of your earnings being taxed as state tax calculation based on 2021 Iowa State Tax Tables.

What To Do When The Irs Is After You Irs Personal Finance Lessons Earn More Money

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions

Capital Gains Tax Calculator Real Estate 1031 Exchange Capital Gains Tax Capital Gain What Is Capital

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Daycare Costs Child Support

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

The Right Age To File For Social Security 10 Factors To Consider Youtube Social Security Social How To Find Out

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Our Free Cost Of Living Calculator Allows You To Compare The Cost Of Living In Your Current City To Anothe Retirement Calculator Best Savings Account Financial

Trulia Mortgage Center Goes Live Agbeat Mortgage Mortgage Payment Calculator Mortgage Loans

Income Tax Calculator Estimate Your Refund In Seconds For Free

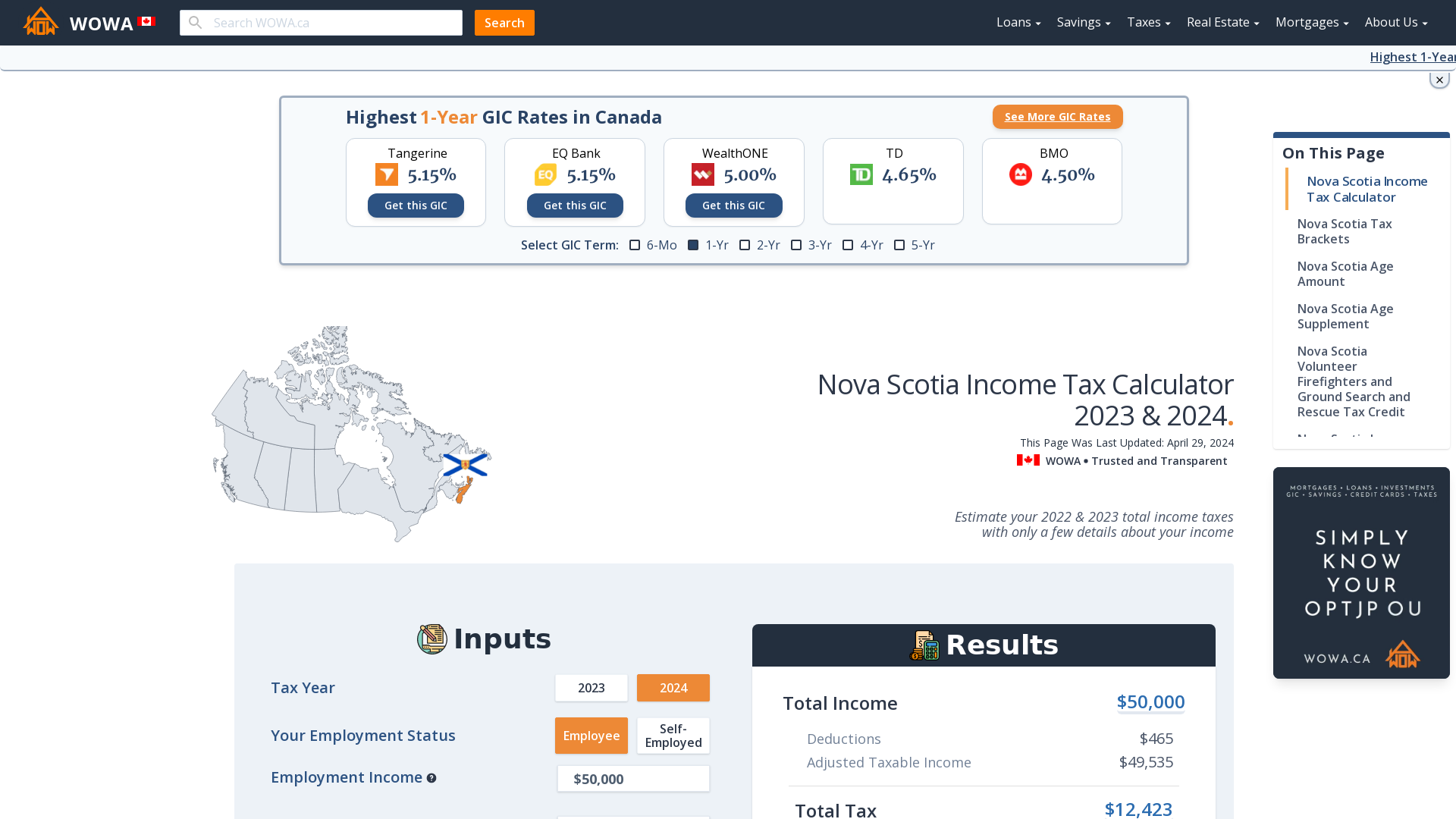

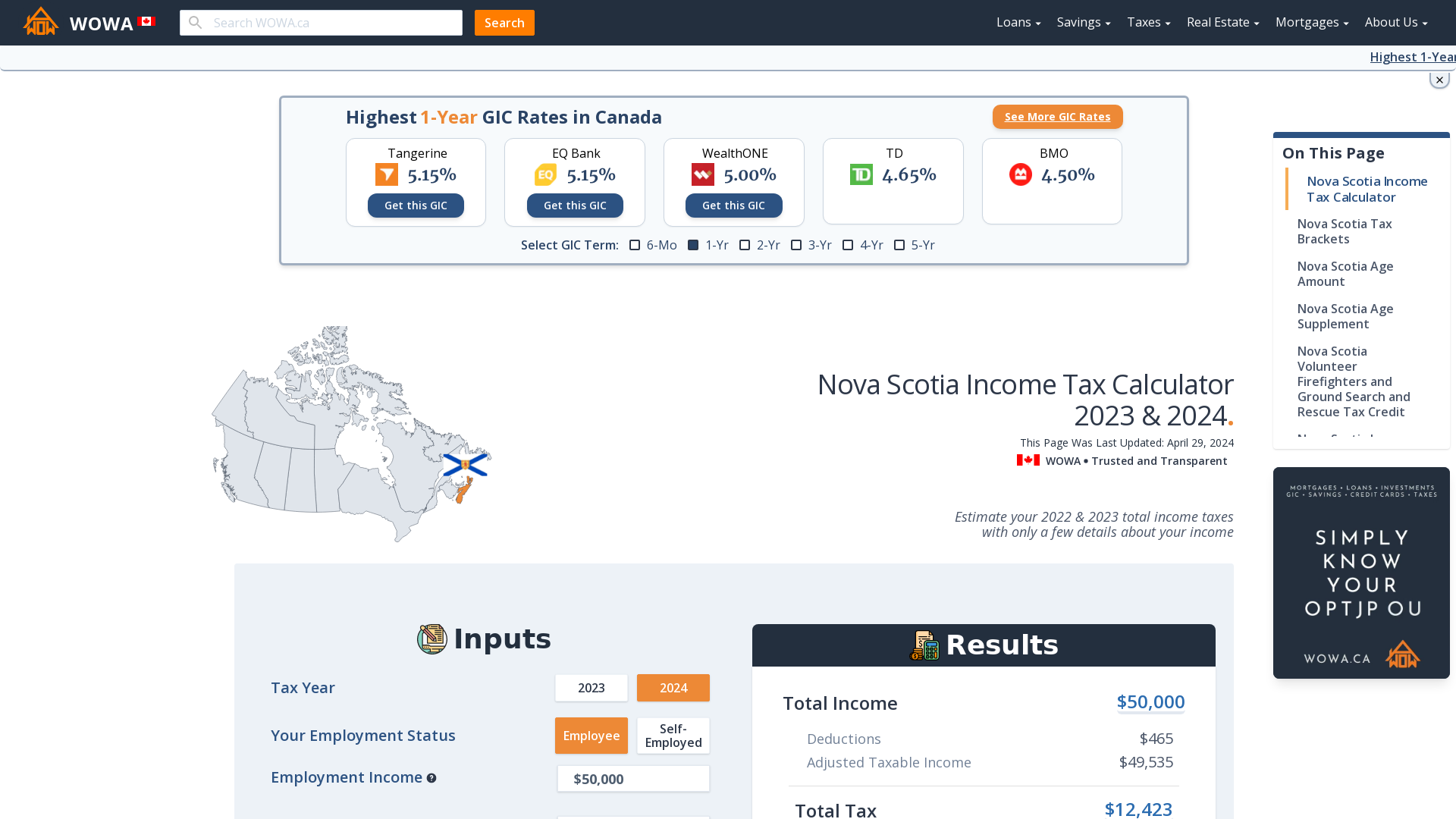

Nova Scotia Income Tax Calculator Wowa Ca

Income Tax Calculator 2021 2022 Estimate Return Refund

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Ecommerce Businesses Can Integrate Shopping Carts Automatically From Walmart Amazon Shopify And Ebay Sales Tax Filing Taxes Revenue

State Sales Tax Help Tax Help Sales Tax Tax

Tax Withholding For Pensions And Social Security Sensible Money